Lenders and analysts are often buried under stacks of financial statements that need to be processed before any decision can be made. Manual work slows everything down and leaves too much room for small but costly mistakes. That’s why automation in financial spreading has become a topic worth paying attention to.

In this blog, you’ll see five practical benefits that automation brings, including accuracy, speed, efficiency, deeper insights, and system consistency, and why adopting these tools can change the way financial teams work for the better.

1. Reduced Errors and Higher Precision

When you handle financial data by hand, you rely on someone typing figures into spreadsheets for hours at a time. Even the most skilled staff can make typos or misplace a number, and those small errors multiply as data flows through your reports. Automated financial spreading reduces that risk by pulling and aligning data with far greater accuracy.

For you, that means confidence in the numbers you use to assess a borrower’s ability to pay. It also helps when auditors review your files because the process leaves behind a digital trail that can be verified quickly. Instead of triple-checking every cell in a spreadsheet, you can focus on the larger picture, what those numbers actually tell you about financial health.

2. Faster Processing and Quicker Decisions

Time is always ticking in the financial industry. Borrowers don’t want to wait weeks to hear back, and your team doesn’t want bottlenecks holding up approvals. Automating financial spreading speeds up the process by reading statements, whether scanned or digital, and placing them in structured formats almost instantly.

The difference is huge. Tasks that used to take days can now be done in hours. Some platforms even provide same-day spreading, which means you can move forward with credit decisions almost immediately. For your clients, this reduces frustration.

For you, it clears the path to handling more applications in less time. Faster responses also show borrowers that your institution values their business and respects their deadlines, which strengthens long-term relationships.

3. Scalability and Improved Efficiency

As your portfolio grows, the workload grows with it. Adding more staff might feel like the obvious answer, but that approach is costly and not always sustainable. Automation gives you scalability without requiring a proportional increase in headcount. A single system can handle thousands of statements at once, and it doesn’t need overtime pay or time off.

Efficiency gains are another advantage. Some reports suggest productivity can improve by up to 40 percent when institutions switch to automated spreading. Costs can drop significantly, too, sometimes by 70 percent, because less manual labor is required.

With that extra capacity, your team can spend more energy on building relationships with clients, refining credit policies, or exploring new opportunities. Instead of drowning in repetitive data entry, you’ll free up resources for work that actually grows the business.

4. Richer Insights and Real-Time Visibility

Manual work often leaves you with just the basics: a set of financial statements lined up in columns. Automation goes further. With the right system, you can spot patterns over time, identify early warning signs, and compare results across industries or regions in real time. That kind of visibility is tough to achieve when you’re juggling spreadsheets on your own.

For example, you might notice a borrower’s cash flow slipping long before it becomes a default risk, or you could track profitability trends that highlight new investment opportunities.

Automated spreading makes these patterns clear and accessible, which allows you to respond quickly. Instead of waiting until the end of the quarter, you can analyze performance as it unfolds. That responsiveness strengthens your decision-making and helps you stay ahead of the curve.

5. Consistency and Seamless Integration

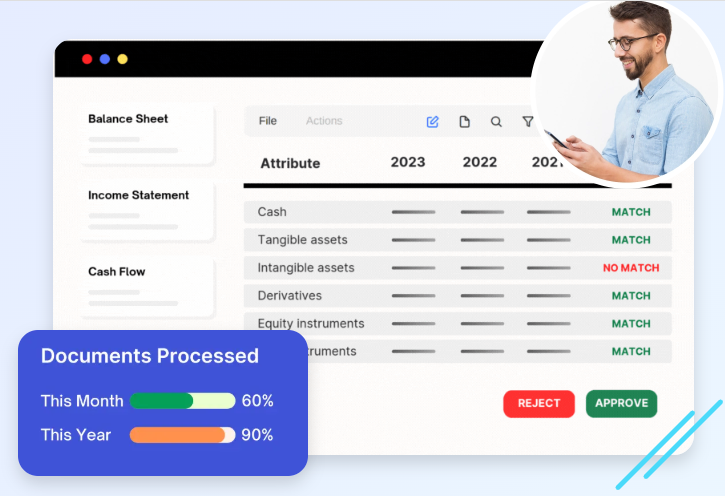

Consistency is often overlooked until you run into mismatched numbers across different teams. One analyst labels an item one way, another calls it something else, and suddenly reports don’t line up. Automated financial spreading avoids that problem by applying the same standards to every statement it processes. The output is uniform, which means everyone, from credit officers to regulators, sees the same story.

Integration with other systems adds another layer of value. Spreading tools can connect with loan origination systems, risk management platforms, and reporting software, reducing the need to re-enter data multiple times.

That saves you effort and also reduces the chance of introducing errors. The more consistent your data, the smoother your operations become, and the easier it is to produce reliable reports on demand.

Conclusion

As automation’s role in financial spreading becomes bigger, the future of credit analysis looks brighter. You’ll see not only cleaner data and faster turnaround but also smarter insights that guide long-term decisions.

The next stage will likely bring even more intelligence, with machine learning spotting risks or opportunities before a human analyst even notices. By adopting these tools now, you prepare your organization to handle the growing demands of tomorrow with confidence. The numbers will always matter, but how you process them is what will set you apart.